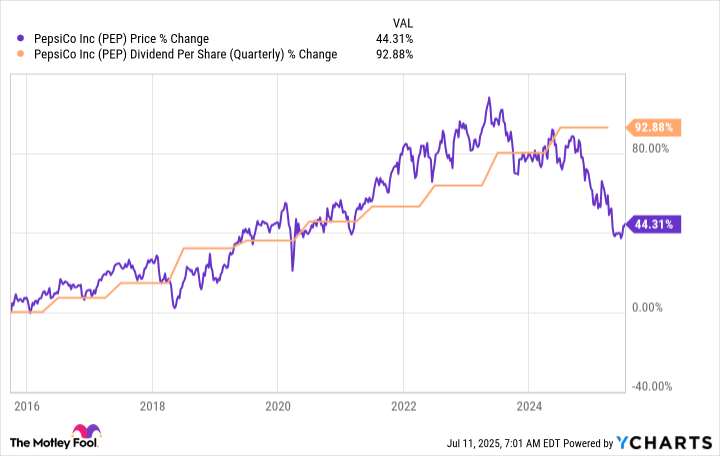

The S&P 500, ah yes, floating on its cloud of blissful ignorance near the heavens. But who deigns to mention the chilling specter of bear markets these days? Take PepsiCo (PEP), a veritable titan brought low—at least, low-ish—with a 30% tumble from its 2023 zenith. A personal bear market, you say? Like a minor existential crisis for a snack food empire! For the contrarian, the value seeker, the dividend worshipper—and, naturally, the dividend *growth* enthusiast—this presents… an opportunity? One must consider, of course. 🧐

PepsiCo: An Empire of… Sustenance?

Let us begin with the obvious: they sell food. A necessity, you might say, for mere survival. But unlike those… *lesser* companies, PepsiCo isn’t obsessed with a single, fleeting fancy. A diversified portfolio, a veritable cornucopia of consumer desires! The soda, naturally, their namesake—a sugary elixir of… well, never mind. But also Frito-Lay, a kingdom of salt and crunch, and Quaker Oats, a nostalgic embrace of… oatmeal. Multiple avenues for growth, multiple cushions to soften the inevitable blows of fate. A pragmatic approach, wouldn’t you agree? 🤔

Нужна вдумчивая аналитика макроэкономики? Подписывайся на канал ТопМоб, чтобы не пропустить разворот рынка!

Подписаться сейчас!But there is more! A global reach, a network of distribution that rivals the Russian railway system, marketing prowess bordering on… persuasion, and R&D labs brimming with the secrets of flavor enhancement. They can face any competitor, lock eyes, and… probably offer them a free bag of chips. And with their vast resources, they can simply *consume* smaller brands, absorbing them into the PepsiCo behemoth to maintain relevance. Poppi and Siete Foods, recent acquisitions… swallowing the upstarts whole. A well-run machine, wouldn’t you say? A rather… efficient machine. 😈

This efficiency is confirmed by their status as a Dividend King—over five decades of steadily increasing payouts! One does not simply *accidentally* build such a record. It requires discipline, foresight, and a business model that can withstand the storms of both boom and bust. A true testament to… well, capitalism, I suppose. 🤷♀️

A Moment of Weakness?

Alas, even empires falter. PepsiCo finds itself in a… slump. Growth has slowed to a pathetic crawl, lagging behind its rivals. The company itself admits that more challenges loom on the horizon. But, as with any wounded beast, it claws and struggles. Poppi and Siete are attempts to reignite the flame, to inject new vitality into the aging giant. But turning such a massive ship… it takes time. A long time. A positively *eternity* in the impatient world of finance. ⏳

And this, my friends, is where opportunity knocks—or rather, gently taps with a hesitant finger. The price-to-sales, price-to-earnings, price-to-book ratios… all below their historical averages. The dividend yield, a generous 4.3%, flirting with record highs. A bargain, you say? Perhaps. For those with a penchant for value or a weakness for income, PepsiCo appears… inexpensive. A rather attractive price, considering the sheer scale of the enterprise. 😏

The contrarian, of course, revels in the disdain with which the market treats PepsiCo. Wall Street acts as if it’s doomed to eternal second place to Coca-Cola, forgetting that these two titans have swapped positions throughout history. To buy PepsiCo now is to bet on the underdog, even if logic offers no compelling reason to believe in an eventual reversal of fortune. A gamble, perhaps? But isn’t all of life a gamble? 🎲

The high yield, coupled with the decades-long history of dividend growth, will attract the attention of the income-minded and the growth-and-income seekers. A 7% compound annual growth rate over the past decade! The dividend has *doubled* in ten years. One can scarcely complain, can one? Though near-term growth may be restrained, a return to form could unleash a new wave of dividend increases. A hopeful thought, at least. 🙏

A Millionaire’s Dream? Or a Modest Fortune?

PepsiCo alone, alas, will likely not transform you into a Croesus overnight. Unless, of course, you possess a truly extraordinary sum of capital to invest. But it can serve as a cornerstone of a diversified portfolio, providing steady growth and reliable income over the long haul. And, as we have established, it currently appears to be on sale, languishing in its own little bear market. A tempting proposition, wouldn’t you say? But remember, dear investor, the road to riches is paved with… well, with cautious optimism and a healthy dose of skepticism. Especially these days. 🙄

Смотрите также

- Серебро прогноз

- Прогноз нефти

- Циан акции прогноз. Цена CNRU

- Озон Фармацевтика акции прогноз. Цена OZPH

- ЭсЭфАй акции прогноз. Цена SFIN

- Сбербанк акции прогноз. Цена SBER

- Золото прогноз

- Банк ВТБ акции прогноз. Цена VTBR

- СПБ Биржа акции прогноз. Цена SPBE

- Корпоративный Центр Икс 5 акции прогноз. Цена X5

2025-07-19 12:05