- ETH Options traders have donned their bullish capes for the Pectra upgrade!

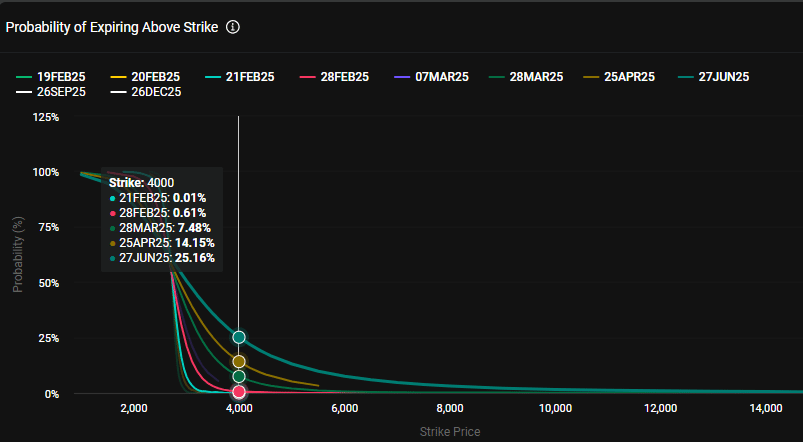

- Markets believe there’s a 14% chance altcoin will hit $4k by the end of April—nature loves surprises! 🌸

In the brightening dawn of Ethereum’s Pectra upgrade, traders have begun to stir, raising their eyebrows at the historical maxim: “buy the rumor, sell the news.” A common jest among market players, though if history were a valid predictor, one might consider investing in crystal balls. The upgrade is expected to grace us in early April, provided the testnet on February 24 and March 5 unfolds according to plan—fingers crossed! 🤞

According to the intrepid minds at the crypto options trading desk, QCP Capital, traders are bustling about with bullish enthusiasm—what a sight! They muse,

Нужна вдумчивая аналитика макроэкономики? Подписывайся на канал ТопМоб, чтобы не пропустить разворот рынка!

Наш Телеграм-канал“Traders are positioning for yet another volatility extravaganza, with the wind favoring calls from March 28 onward. A theatrical setting for the next grand positioning act awaits.”

Will Pectra Fire Up an ETH Fiesta? 🎉

In the annals of market folklore, it seems that every upgrade has sparked a riot of bullish anticipations only to be met with the sobering reality of post-event sell-offs. The only shining exception? The revered Shanghai upgrade—our star of April 2024! QCP Capital harkens back in reflection, noting:

“The Merge (September 2022) → Classic tale of ‘buy the rumor, sell the news’, wherein ETH soared over 100% from June lows, only to tumble after the ruckus. Shanghai (April 2023) → Panic over excess supply, yet it turned tail and climbed 30% when selling pressure evaporated!”

For those wandering acolytes not yet initiated into the ways of Pectra, its noble mission is to unveil eleven crucial features, with blob expansion and the enchanting promise of smart wallets leading the charge.

From the swirling mists of speculation, the scalability efforts seem to bear fruit! Recently, Ethereum’s average transaction cost has been vying with Solana’s, having dipped to a miraculous sub-1 gwei in gas charges—who knew it could be so cheap? 💸

Yet, despite this newfound frugality, the demand for Layer 1 solutions remains as elusive as a cat video on the internet—will Pectra alter this narrative? Only time will tell! ⏳

Is a $4k ETH Reclamation Likely? 🤑

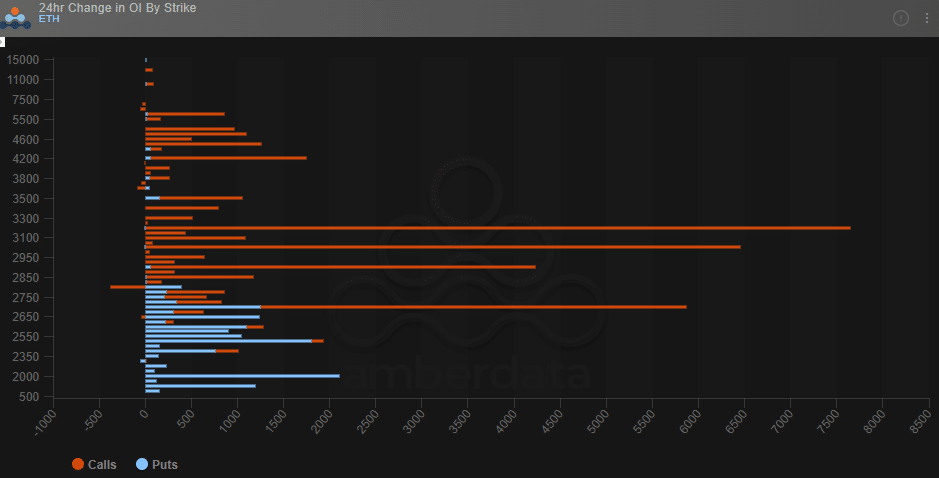

Alas, the last 24 hours tell a tale of optimistic calls eyeing the $3.2k and $3k price milestones—the reigning champions of bullish bets. Meanwhile, puts lurk at the $2k target, a little insurance policy in case things go south. Trader musings suggest that, in the short term, they fancy a surge to $3.2k while having $2k as their safety net amidst a storm of bear antics.

However, the options market seems less than optimistic regarding our dear ETH reclaiming the lofty $4k by the end of April post-Pectra upgrade. Current sentiment pegs this at a mere 14% chance, although the June horizons look a tad rosier, with odds of 25%—which is to say the beaches might be a more favorable habitat for a summer return! 🏖️

The Buildup of ETH Enthusiasm 🌟

Even in the face of lackluster price action, a certain feverish accumulation of ETH whispers through the market as keen investors whisk their tokens off exchanges, a veritable game of hide and seek!

On February 5, a bold 367k ETH made its grand escape from exchanges—a clear sign of bullish candor as our digital coin dips below the $3k mark, a moment fraught with significance!

Will this fervent accumulation trend serve to boost ETH’s pricing clout? A pondering question still, much rests on the tides of broader market sentiment. 🏄♂️

Смотрите также

- Серебро прогноз

- Объединенная авиастроительная корпорация акции прогноз. Цена UNAC

- Золото прогноз

- Банк ВТБ акции прогноз. Цена VTBR

- Озон Фармацевтика акции прогноз. Цена OZPH

- Пермэнергосбыт префы прогноз. Цена PMSBP

- Прогноз нефти

- Группа Аренадата акции прогноз. Цена DATA

- Яндекс акции прогноз. Цена YDEX

- ТГК-14 акции прогноз. Цена TGKN

2025-02-19 11:05