One might be forgiven for thinking that Netflix (NFLX), that purveyor of moving pictures for the modern gentleman’s leisure, has lost its youthful dash. A decade ago, it was the very picture of a thrilling investment, you see. Yet, bless my soul, it has shown a most remarkable resilience these past few years, defying the murmurings of those who declared it a company rather past its prime. A rather spirited dash indeed!

After a bit of a wobble in 2022 – a temporary, shall we say, decline in the number of chaps and chapesses subscribing to its services, you understand – Netflix, with commendable pluck, returned to its drawing boards. It introduced a most unexpected offering: an advertising tier, after years of declaring such a thing utterly unthinkable. And, with a firm hand, it dealt with the rather tiresome business of password-sharing, and even dabbled in the exciting world of live sporting events – a most diverting turn of affairs, what!

Нужна вдумчивая аналитика макроэкономики? Подписывайся на канал ТопМоб, чтобы не пропустить разворот рынка!

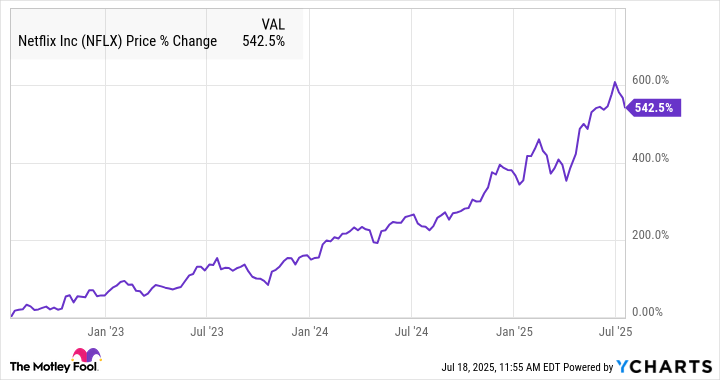

Наш Телеграм-каналThe result, my dear readers, has been quite extraordinary. The stock has practically taken flight, soaring upwards by a positively dizzying 500% over the last three years, as the chart below so delightfully illustrates.

To expect such a breathtaking performance to be repeated in the next three years is, perhaps, a bit optimistic, unless, of course, Netflix unveils a truly ingenious expansion of its operations. However, a doubling of the stock’s value does seem a reasonable ambition, wouldn’t you agree? Recent pronouncements from the company’s boardroom have offered us a few tantalizing clues.

A Most Pleasant Quarter, Though the Market Showed a Hint of Discomfort

The market, rather surprisingly, reacted with a touch of coolness to the second-quarter report last Friday, the stock price dipping a mere 5%, mind you. The numbers, however, were undeniably robust. Expectations, fuelled by the stock’s recent ascent, had been raised to a rather giddy height. Revenue climbed a sprightly 16% to $11.1 billion, representing its most impressive growth rate in four quarters, although it did rather precisely match the expectations of the financial chaps.

The reporting of subscriber numbers has, alas, been discontinued, making it somewhat trickier to ascertain precisely what’s propelling this upward trajectory. Management attributes the growth to a confluence of factors: a pleasing increase in subscribers, a burgeoning advertisement enterprise, and judicious adjustments to pricing in markets such as North America. The company has now fully embraced advertising, utilising its own clever Netflix Ads Suite platform across all its territories. A rather clever bit of code, what!

Thanks to its rather ingenious subscription model, the company’s profit margins continue to expand as the business grows. And the advertising venture, one suspects, is contributing significantly to this expansion, permitting the monetization of its content in a novel manner and attracting subscribers who are, let’s be frank, somewhat averse to extravagant spending. Operating margin has risen from 27.2% to a positively splendid 34.1%, and earnings per share have leaped from $4.88 to $7.19, exceeding the consensus estimate of $7.06 by a comfortable margin.

One minor caveat, however: Management cautioned that margins might soften somewhat in the latter half of the year, owing to increased content expenses. Their third-quarter forecast anticipates an operating margin of 31.5%, but they have, most reassuringly, raised their full-year guidance from $43.5 billion–$44.5 billion to a rather agreeable $44.8 billion–$45.2 billion. Currency-neutral operating margin is now expected to expand to 29.5%, a noteworthy improvement over the previous projection of 29%.

The business seems to be humming along quite nicely, with the advertising engine gathering momentum. Netflix continues to broaden its range of content, with several series and films attracting audiences numbering upwards of 50 million – a truly remarkable feat, wouldn’t you say?

Members consumed a staggering 95 billion hours during the first half of the year, representing a modest 1% increase. And the company’s strategy of producing local content is proving exceptionally rewarding, as non-English content now constitutes more than a third of all viewing. These trends, my friends, bode exceptionally well for the business over the next three years.

The Question of $2,500: A Bold Ambition?

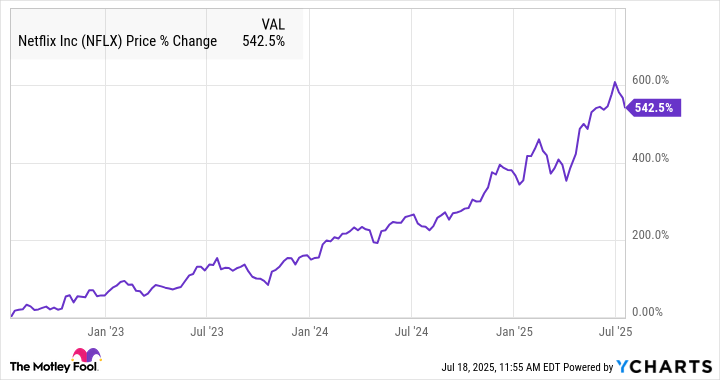

Netflix’s recent ascent has been underpinned not only by improvements in the underlying business, but also by a rather generous expansion of the price-to-earnings ratio. One can observe this phenomenon clearly in the chart below, although, naturally, it doesn’t include the most recent figures.

Factoring in the second-quarter earnings, Netflix’s price-to-earnings ratio currently stands at a rather assertive 50. A pricey proposition, certainly, particularly for a company that was formerly considered to be in a rather mature stage of development.

To achieve a doubling of the stock’s value from its current position will, almost certainly, necessitate that it be earned through its own merits. The market’s reaction to the recent earnings report – a slight sell-off – suggests that many investors believe a considerable portion of future growth is already anticipated. Further gains will, therefore, be more challenging to secure.

Doubling earnings per share, while undoubtedly achievable, may require a timeframe extending beyond three years. Nonetheless, with its impressive double-digit revenue growth, expanding operating margins, and the potential for expansion into fresh, unexplored territories, a doubling of EPS within the next five years seems a perfectly reasonable, if somewhat ambitious, assumption.

The streaming stock may, indeed, double by 2028, but it will need to clear a rather formidable hurdle. A task not to be undertaken lightly, you see! 🧐

Смотрите также

- Серебро прогноз

- Озон Фармацевтика акции прогноз. Цена OZPH

- Прогноз нефти

- Норникель акции прогноз. Цена GMKN

- Полюс акции прогноз. Цена PLZL

- Золото прогноз

- Прогноз курса доллара к рублю

- Яндекс акции прогноз. Цена YDEX

- Группа Астра акции прогноз. Цена ASTR

- Русолово акции прогноз. Цена ROLO

2025-07-22 10:56